Virginia-class submarine Delaware (SSN-791) was moved out of a construction facility into a floating dry dock using a transfer car system in 2018. HII Photo

Huntington Ingalls Industries is confident its businesses are well-positioned for whatever the future of the Navy is – whether it’s the implementation of the Pentagon’s Battle Force 2045 plan or something else implemented by new leadership, according to the chief executive.

HII president and CEO Mike Petters told investors on Thursday that “we are pleased to see our portfolio of ships in the (Battle Force 2045) plan and recognize that there is still much work to be done to bring any plan to fruition.”

“We remain confident that we can create additional capacity that may be necessary to support even the most robust shipbuilding plan,” he added.

Asked by investors what a potential change in administration means for the company’s outlook, Petters said that “national security tends to be pretty bipartisan, and the Pentagon tends to operate in a world where they’re looking external to the country, trying to figure out how to do security. This Pentagon has said we need a bigger Navy to be more secure, and they’re working through that process right now. If you have a change in the leadership, in the administration, the new folks are going to be looking at the same outside world that the folks that are there now are. And there might be changes on the edges – is it this many ships or that many ships, or anything like. What I take away from what has been said so far is that the future Navy needs to be bigger, it needs to be faster, cheaper, and probably a bit smaller in terms of sizes of ships. So a faster, cheaper, smaller set of platforms, with a lot more of them. We believe that’s going to persist.”

Specifically, he said, the undersea domain – both manned submarines and unmanned undersea vehicles – will be at the center of future fleet growth.

On the submarine side, HII’s Newport News Shipbuilding ran into some struggles on the Block IV Virginia-class SSN deliveries. Some of the delays predate the pandemic, as the supply base and the two shipyards struggled to get up to a two-a-year construction rate. COVID-19 has only increased the challenge, with Petters saying during the last quarterly earnings call in August that the Navy asked Newport News to prioritize repair work – on submarines and aircraft carriers – with the workers who were able to come in on any given day, meaning that the submarine construction side of the business fell further behind.

At this point, Petters said this week, workforce attendance is up compared to the spring, and while the company hasn’t figured out how to catch back up on Virginia-class construction, they’re not falling further behind anymore.

“We took a pretty big divot in attendance in April and May. Where we’ve been since then is, we’ve been pretty steady in terms of what we can predict in terms of the number of people who are going to be there and who’s going to be there and how to allocate those resources. So that’s working very well for us, and it’s really consistent with the schedules that we reset at the end of Q2,” he said.

Petters said the company had about 200 active COVID cases in its workforce now, but due to increases in testing the company can keep fewer people in quarantine and can better predict how the virus is affecting the workforce and therefore how many welders, how many electricians, how many pipefitters they might have on any given day and how to allocate them across all the shipbuilding and ship repair activities.

After revamping the SSN construction schedule after falling so far behind in the second quarter of the year, “we’re tracking the new schedules. The opportunity to really recover the divot that we took out, we haven’t quite figured out how to go and accelerate back to where we were in terms of schedule. But we’re working on that. But we’re definitely supporting the new schedules we have laid out.”

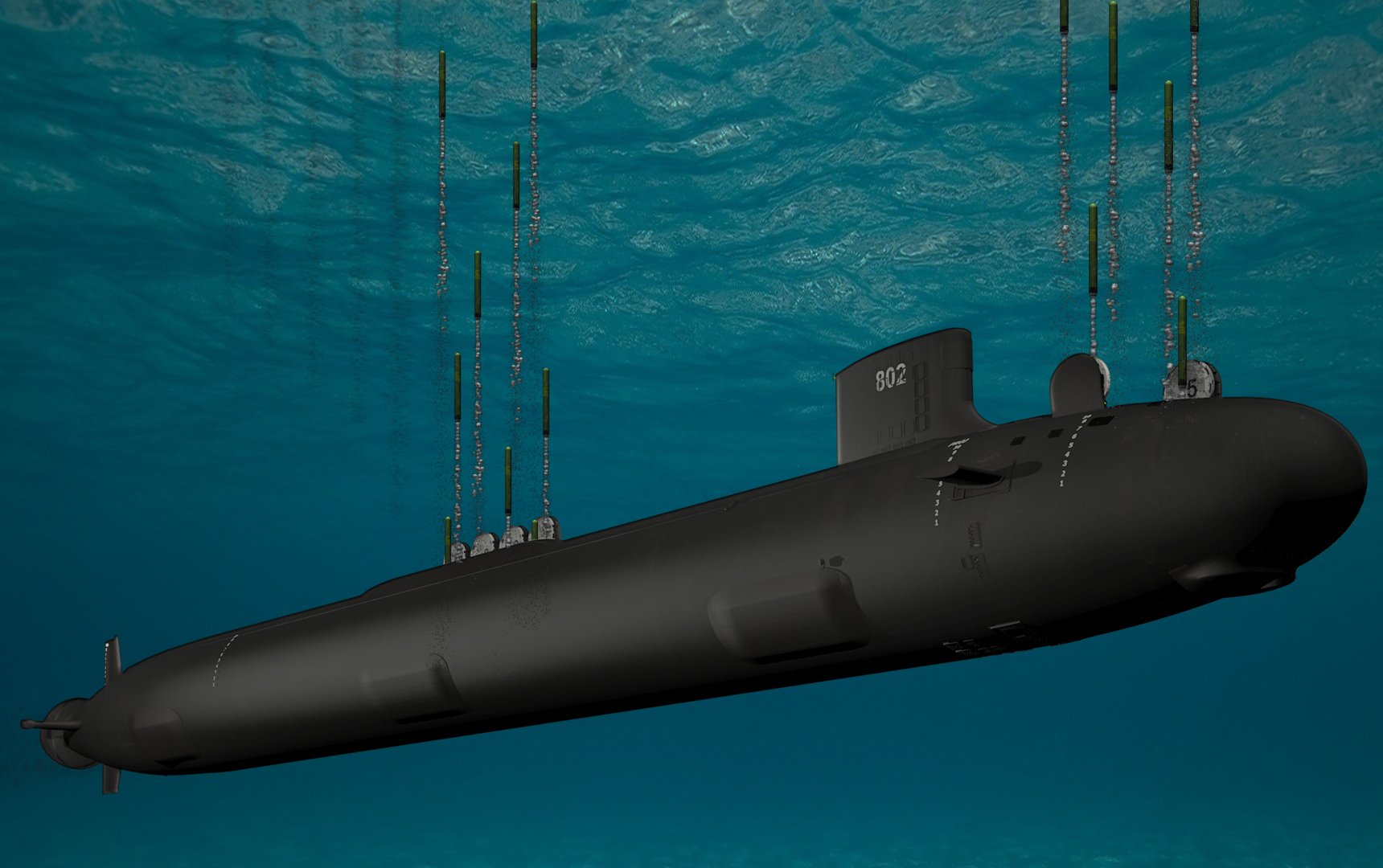

Rendering of Block V Virginia-class submarine with Virginia Payload Module. General Dynamics Electric Boat Image

In the longer term, Battle Force 2045 calls for a larger attack submarine force, and Defense Secretary Mark Esper called for the Navy to quickly begin buying three SSNs a year – which would put significant pressure on Newport News Shipbuilding and General Dynamics’ Electric Boat, as well as thousands of suppliers across the country, to ramp up production even as they’re readying to start construction on the Columbia-class ballistic missile submarine, the contract for which was awarded Thursday.

Petters said he was confident industry could act to grow their capacity faster than the government could actually get appropriations and contract modifications into place – though he said industry would only make moves to expand if the government was truly committed to buying more submarines over a long timeframe.

“I think the shipyards will have to build, maybe invest in more capacity and more workforce. I think that we’re going to have to create some parallel capacity, maybe think a little bit more about buying pieces that we were doing organically before, maybe structural units or fittings or foundations or something like that. … And then I think you really have to be focused: if you ‘re going to get it there, you really have to get the supply chain up to speed. Our supply chain in support of all of shipbuilding, but in particular our nuclear enterprise, it’s very capable, but it’s also kind of thin. So you really need to have a persistent, consistent, sustainable set of messaging to the industry that you’re going to sustain this rate for a significant time to create or attract the investment in technology, capital and people that the supply chain’s going to need to go do,” Petters said.

“I think there is the capacity to go do that, but it ain’t a light switch and you don’t turn it on overnight. My rule of thumb though is that if you’re persistent on these signals from the government, the capacity in the industry can be built faster than the government can appropriate the funding to go do it. It takes so long to get to the appropriations process, there’s a whole set of signals and long lead times and [requests for proposals] and things like that that would let the industry know you’re really serious about doing it,” he added.

Navy acquisition chief James Geurts and Electric Boat President Kevin Graney spoke at a separate event Thursday and reiterated to reporters that the whole industry was in a position to ramp up if the Navy became serious about buying more than two Virginias a year.

Geurts said the Navy had an undersea advantage today that needed to be expanded in both capability and capacity.

“It will take investment to enable us to move to a larger program than we have right now,” he said, which is doable, but only if it doesn’t hurt the Columbia program.

“The teams are looking at how do we do that and what are the strategic investments that we need to make now that enable us to expand the industrial capacity, should that be where the department goes?” he said.

“If that’s what we choose to do, we set up the right program to do that, we can deliver whatever industrial capacity output we need for the nation. That won’t happen overnight, it will take careful program planning and some investments, just as we’ve expanded from one Virginia to two Virginias, and two Virginias to two Virginias and a [Virginia Payload Module] to two Virginias and VPM and Columbia. So we know how to do this, I have full confidence in America’s ability to produce these should we do that.”

Graney said during the media call that expanding would take three things: “we’ve got to make sure that the supply base keeps pace as we increase the tempo; we’ve got to make sure that our facilities can accommodate the increased footprint that more modules, for example, for the Virginia program might require; and then the last part – and I think they are kind of in that order – supply base, facilities, and then the last part is really the workforce, training up the workforce and making sure they’re on the floor when the modules are ready to be built.”

He added that talks with the Navy are ongoing to ensure everyone is clear on what it would take to increase submarine construction rates.

For Newport News Shipbuilding’s submarine business, the expansion in work might not be limited to construction. The Navy is increasingly realizing that, regardless of what efficiencies they’re able to accomplish at the four public shipyards to get subs and carriers in and out of maintenance faster, there’s still far too much work for just those yards to accomplish. Naval Sea Systems Command chief Vice Adm. Bill Galinis recently told USNI News that more sub repair work would have to go to private yards – Newport News and Electric Boat – in the future and that the Navy was in talks with the yards to look at what would be needed to increase workload both on the construction and repair side.

Petters said Newport News has three submarine repairs taking place now, plus tiger teams deployed to submarine homeports to help with pierside maintenance work. He acknowledged that getting back into submarine repairs after about a decade of not doing that work has been a challenge, but he said it would be an important part of the portfolio going forward.

“We’re working very closely with the Navy, not just on the work that we have but trying to lay out a sustainable, predictable plan for how the, not just Newport News, but how does the private sector in general support the Navy’s need to have more submarines at sea?” he said.

“That’s a big part of what we’re talking about with the submarine repair business. … That’s also a big part of what’s happening with the future force and the future of the Virginia class and that construction. At the end of the day, I think, no matter how many submarines the nation puts to sea, we’re always going to wish we had more out there. So that’s a good spot for us, and we’re working very hard in that space.”

November 07, 2020 at 03:56AM

https://news.usni.org/2020/11/06/submarine-industrial-base-ready-to-grow-but-only-if-pentagon-congress-send-the-right-signals

Submarine Industrial Base Ready to Grow – But Only If Pentagon, Congress Send the Right Signals - USNI News

https://news.google.com/search?q=Send&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment